EverBee Store's sales tax feature is available in the US as of now.

To collect sales tax, you must connect Stripe as your payment processor. Stripe calculates taxes based on the customer's location and product type, covering over 11,000 tax jurisdictions with high precision. Note that Stripe will only collect taxes from customers within your specified tax region.

Enabling Tax Collection

Navigate to Settings in your Store account

Under Payments and taxes, ensure Stripe is connected.

Scroll to Collect sales Taxes and toggle it on.

Enter the address from which you'll be filing taxes; this determines your tax region.

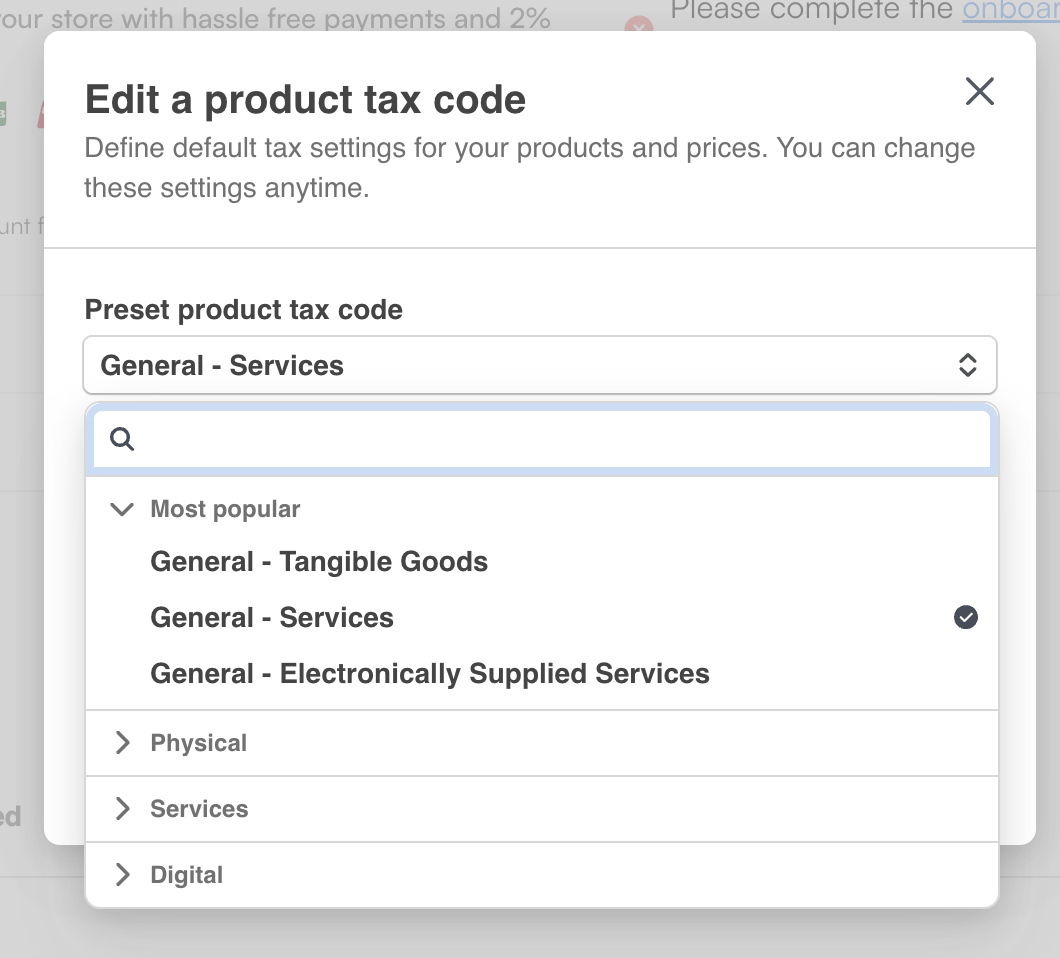

Select your tax code based on the service you are providing

Some other things to consider:

United States: You can only charge tax in the state where you're registered. Note that some states, like Alaska and Oregon, don't have sales tax, and states like New York and California don't tax digital goods.

You will have the option to add your VAT ID to your Stripe Payments account.

If you have specific needs or questions about tax rates, consider consulting a local tax professional.